🥈⏳🔥 Monday Is the Most Important Silver Day in a Generation 🥈⏰

Or else Friday…

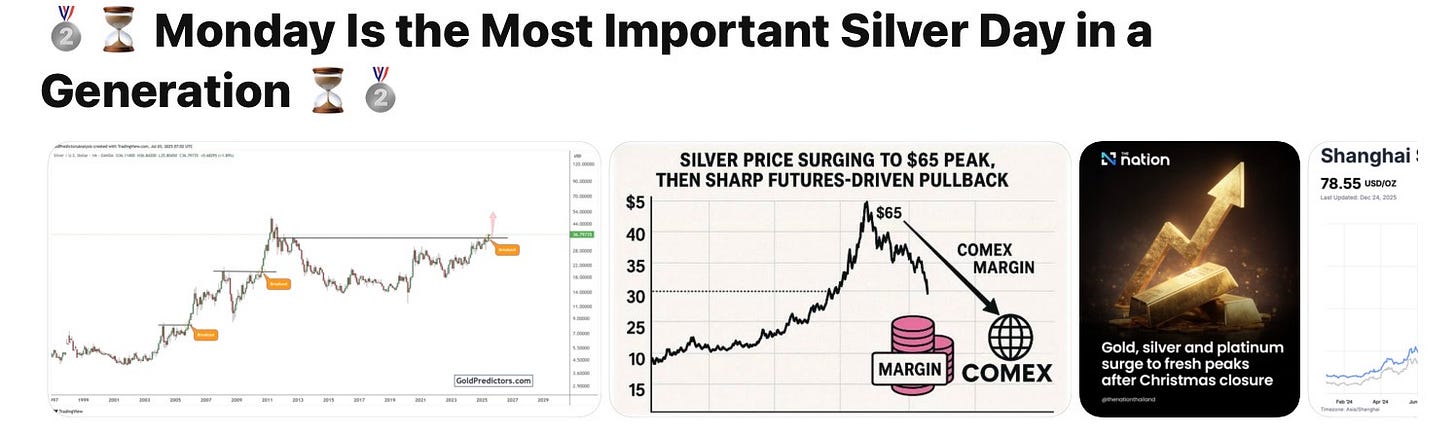

🥈 For at least 60 years — and some would argue closer to 100 — silver has lived inside a managed illusion. 📄 Paper contracts, leverage, margin games, and algorithms replaced real price discovery. But systems only work until they don’t. ⏳ Over the past several weeks, silver has stopped responding to the tools that once controlled it. That’s why Monday matters. ⚠️

💥 Two Outcomes — Both Explosive

There are only two realistic paths left. 🚦 The first is a violent repricing event — thin liquidity, trapped shorts, and access-market strength collide at the open. 🔥 The second is one last delay — another attempt to manage price with paper. The odds are stacked against that working. 🎯

💣 The Margin Hike That Should Have Crashed Silver — But Didn’t

On Friday, December 26, 2025, the CME Group issued Clearing Advisory 25-393, raising initial margin requirements on COMEX silver futures to roughly $25,000 per 5,000-ounce contract, effective Monday, December 29, 2025. 🗓️ The advisory does not specify an exact release time, only the date — a detail worth noting because timing matters. ⏱️

Silver continued trading electronically on Globex until 5:00 PM ET, and Kitco continued reporting prices through that electronic session. 📊 Price action during that window appeared largely unaffected. The market shrugged it off. 🤷♂️

🌍 Sunday 6:00 PM ET: The First Visible Verdict

After Globex halted at 5:00 PM ET Friday, the market went dark for the weekend. 🌑 The next public signal comes when the access market reopens at 6:00 PM Eastern on Sunday. 🌍 That moment will reveal whether the margin hike worked — or failed. ⚖️

Martin Armstrong has long warned that manipulated markets do not unwind gradually. They hold together — until confidence breaks — and then they move violently. 💥

📕 Read The Armstrong Economic Code

Once the 'Army Ants' join the party silver is going to go parabolic.